PCB Industry Growth Rates and Book-to-Bill Ratios Announced

IPC - Association Connecting Electronics Industries® announced today the January findings from its monthly North American Printed Circuit Board (PCB) Statistical Program.

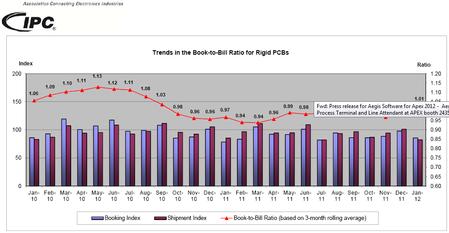

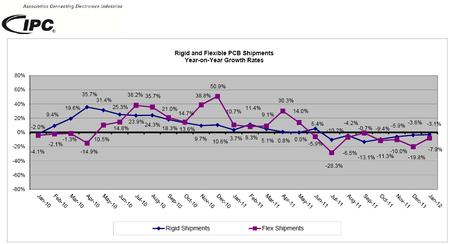

Rigid PCB shipments were down 3.1 percent in January 2012 from January 2011, but bookings increased 10.9 percent year over year. The book-to-bill ratio for the North American rigid PCB industry in January 2012 strengthened to 1.01.

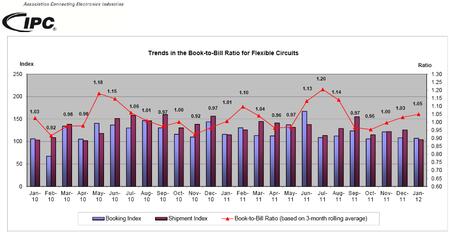

Flexible circuit shipments in January 2012 were down 7.9 percent and bookings were down 29.4 percent compared to January 2011. The North American flexible circuit book-to-bill ratio rose to 1.05.

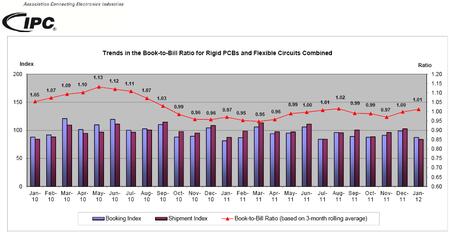

For rigid PCBs and flexible circuits combined, industry shipments in January 2012 decreased 3.5 percent from January 2011, while orders booked increased 6.2 percent from January 2011. The combined (rigid and flex) industry book-to-bill ratio in January 2012 continued to inch up and now stands at 1.01.

“Both rigid PCB and flexible circuit sales followed normal seasonal patterns in January, with sales down from December,” said Sharon Starr, IPC market research director. “The good news,” she added, “is that rigid PCB orders are up and the book-to-bill ratios for both rigid and flex improved again this month. They are now just above parity, which suggests a return to modest growth in the new few months.”

The book-to-bill ratios are calculated by dividing the value of orders booked over the past three months by the value of sales billed during the same period from companies in IPC’s survey sample. A ratio of more than 1.00 suggests that current demand is ahead of supply, which is a positive indicator for sales growth over the next two to three months.

Book-to-bill ratios and growth rates for rigid PCBs and flexible circuits combined are heavily affected by the rigid PCB segment. Rigid PCBs represent an estimated 89 percent of the current PCB industry in North America, according to IPC’s World PCB Production Report.

The Role of Domestic Production

IPC’s monthly survey of the North American PCB industry tracks bookings and shipments from U.S. and Canadian facilities, which provide indicators of regional demand. These numbers do not measure U.S. and Canadian PCB production. To track regional production trends, IPC asks survey participants for the percent of their reported shipments that were produced domestically (i.e., in the USA or Canada). In January 2012, 82 percent of total PCB shipments reported by survey participants in both the rigid PCB and flexible circuit categories were domestically produced. These numbers are significantly affected by the mix of companies in IPC’s survey sample, which change slightly in January, but are kept constant through the remainder of the year.

Bare Circuits versus Assembly

Flexible circuit sales typically include value-added services such as assembly, in addition to the bare flexible circuits. In January, the flexible circuit manufacturers in IPC’s survey sample indicated that bare circuits accounted for about 41 percent of their shipment value reported for the month. Assembly and other services make up a large and growing segment of flexible circuit producers’ businesses. This figure is also sensitive to changes in the survey sample, which may occur at the beginning of each calendar year.

Interpreting the Data

Year-on-year and year-to-date growth rates provide the most meaningful view of industry growth. Month-to-month comparisons should be made with caution as they may reflect cyclical effects and short-term volatility. Because bookings tend to be more volatile than shipments, changes in the book-to-bill ratios from month to month may not be significant unless a trend of more than three consecutive months is apparent. It is also important to consider changes in bookings and shipments to understand what is driving changes in the book-to-bill ratio.

The information in IPC’s monthly PCB industry statistics is based on data provided by a representative sample of both rigid and flexible PCB manufacturers in the USA and Canada. IPC publishes the PCB Book-to-Bill Ratio and the PCB Statistical Program Report each month. Statistics for the previous month are not available until the last week of the following month.

IPC (www.IPC.org) is a global trade association based in Bannockburn, Ill., dedicated to the competitive excellence and financial success of its 3.100 member companies which represent all facets of the electronics industry, including design, printed board manufacturing, electronics assembly and test. As a member-driven organization and leading source for industry standards, training, market research and public policy advocacy, IPC supports programs to meet the needs of an estimated $2.02 trillion global electronics industry. IPC maintains additional offices in Taos, N.M.; Arlington, Va.; Stockholm, Sweden; Moscow, Russia; Bangalore, India; and Shanghai, Shenzhen and Beijing, China.

»

»